2023 Capital Credit Retirement

Members - check your April bill for your capital credit retirement! Central Electric Cooperative's (CEC's) Board of Directors voted to retire $3.1 million in 2023. This is the largest capital credit distribution in the cooperative's history. Capital credits are one of the most significant benefits of being a co-op member and we hope it serves you well.

ooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo

Below are answers to some of CEC's most-asked capital credit questions.

What are capital credits?

Capital Credits reflect each member’s ownership and investment in CEC. Any margins or revenues related to the sale of electric service remaining after all expenses have been paid are returned to the cooperative’s members in proportion to their electrical use. The retirement of capital credits is unique to the cooperative business model and is one of the most important things we do as a co-op.

What does the capital credit process look like?

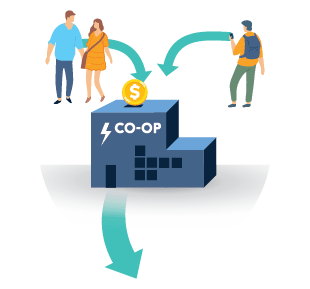

1. Money comes in from members when they pay their electric bills.

Electric bills can be thought of as each member’s share of the funds needed for their cooperative to run.

2. Money goes out to pay co-op expenses.

Members’ dollars are pooled together and used as operating capital so the co-op can provide reliable service and pay co-op expenses.

3. A little bit is set aside for the future.

Capital credit funds are retained for a period of time for long-term improvements and maintenance of the co-op equipment, to ensure reliable service. This keeps rates lower by offsetting the need for the cooperative to borrow funds.

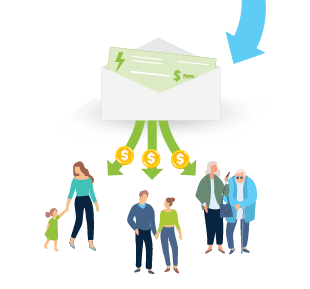

4. Any funds left over are returned to members at a later date.

Capital credits are allocated to members based on their energy purchases. When the financial condition of the co-op

allows, capital credits are retired (paid) to each member in the form of either a check or a credit on their electric bill.

What does CEC do with unclaimed capital credits?

CEC does its best to seek out former members who are due capital credits, even if they are no longer on our system. If the member does not claim them and the capital credits remain unclaimed for four years or more, they are transferred to a fund for charitable and educational purposes. These include, but are not limited to, scholarships, sponsoring the Youth Tour to Washington D.C., and various community donations.

Click here to search for unclaimed capital credits.

What happens to my family member's capital credits if they have passed away?

CEC’s Board of Directors will allow the capital credits to be retired early or paid back to the legal representative(s) of your family member’s estate. In order to claim them, an affidavit is required to be completed, notarized, and returned in addition to a copy of the death certificate and personal representative appointment documentation, if one was appointed.

Capital credits that are claimed early due to the death of a family member are returned at a discounted rate.

Have other capital credit questions?

Please call our office at 800-521-0570.